(Nathan Dumlao/Unsplash)

In my line of work, I spot a lot of questionable takes, but even some of those takes have a root of truth to them despite the questionable logic.

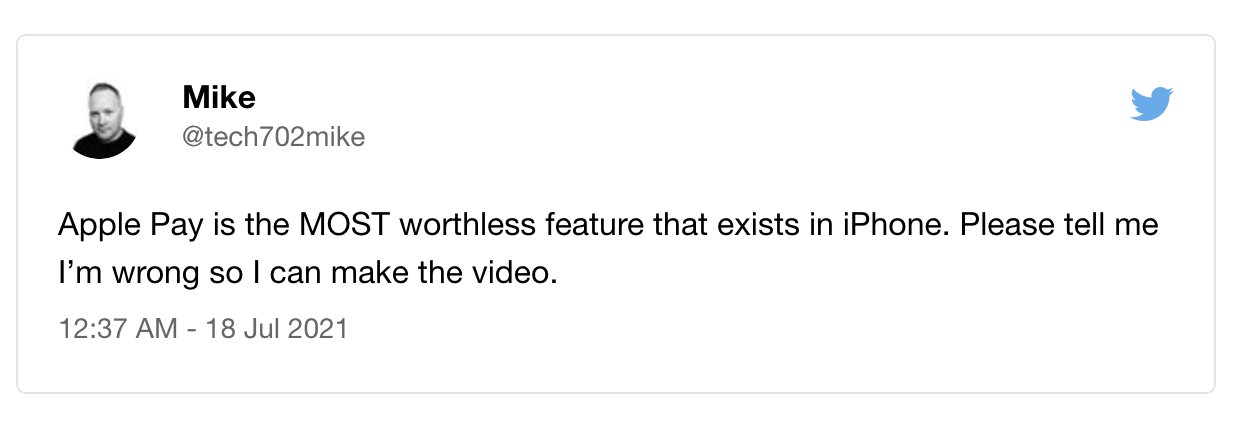

I had to keep that in mind over the weekend when I saw a guy complaining about Apple Pay (specifically NFC) not working particularly well on Twitter over the weekend.

The guy deleted the tweet, but screenshots are forever.

It was definitely a ratio situation, though a relatively small one.

And in some ways, his point is totally valid. When it comes down to it, he cannot use his phone to pay for things, something that most phones have supported for years—in Apple’s case, since at least 2014.

But his target is off the mark. The thing is, the reason he’s not able to do so, comes down to a mixture of his own personal lifestyle, his location (i.e. this is a U.S.-only problem that many other parts of the world don’t have), and a concerted effort at industry resistance that long predates his complaint.

To explain this, let me note that despite NFC clearly having the inside line as a successful payment technology for years, thanks to the support of both mobile and the banking industry, retailers in the U.S. saw the rise of mobile phones as an opportunity to get around something that had been bugging them for years—interchange fees, or “swipe fees.” See, when debit cards first went into wide use, retailers were charged expensive interchange fees every time a transaction took place. These fees are comparable to, say, the 30 percent cut that everyone’s always complaining about with the App Store, if at a smaller scale.

For understandable reasons, and keeping in mind some early success stories such as Starbucks, mobile was seen as an opportunity to wrestle away some control from the banking industry, making them closer in use case to, say, gift cards. Retailers such as Walmart, which were large enough that they could feasibly push a standard on their own, took the opportunity to support new mobile standards, most notably in the form of Merchant Customer Exchange (MCX). But their attempts at standards-making just couldn’t compete with a solution that was christened by the phone-makers themselves, complete with built-in hardware.

(I wrote about this for my day job as far back as 2014. Multiple times, even.)

Despite this, though, many former MCX members have notably dragged their feet on NFC within the U.S. because of a desire to access customer purchase data, which they can then use to make better business decisions. (That state of affairs is gradually changing, though.)

And since Apple prizes a user’s privacy over the business interests of anyone else, that’s why Walmart wants you to pay with its own made-up solution that uses QR codes. Walmart wants your data.

Now, if you’re shopping only at the kinds of chains that would support something like MCX—and not, say, a small business that uses something like Square—you’re probably going to have problems using NFC, despite the fact that in most parts of the world, NFC is just as common as chip cards were a decade ago. Yes, American companies suck at financial technology standardization, and the guy who tweeted shops at Walmart.

Because, the thing is this: No matter how cool your technology is, the truth is that some outside force with their own monied interests is going to be there to screw it up.

So that’s why Apple Pay sucks for this random guy.

Time limit given ⏲: 30 minutes

Time left on clock ⏲: alarm goes off